The artificial intelligence gold rush has produced two undisputed titans: Nvidia, the company building the shovels, and Palantir, the company promising to map the goldfields. Since the AI mania kicked off in early 2023, both have delivered staggering returns, with Nvidia and Palantir shares soaring 1,190% and 2,810%, respectively. Yet, beneath the surface of this shared success, a deep chasm has opened in the collective mind of Wall Street.

Analysts, tasked with peering into the future, have reached a startlingly divergent consensus. For Nvidia, the message is clear: buy. The average price target among 66 analysts suggests a 15% upside from its current levels. For Palantir, the verdict is just as decisive but far more brutal: sell. The consensus among 29 analysts, as detailed in reports like Nvidia Stock vs. Palantir Stock: Wall Street Says Buy One and Sell the Other, implies a 15% downside.

This isn't just a minor disagreement over growth rates. It's a fundamental split in how the market is pricing hardware dominance versus software potential. One is seen as a fortress built on tangible, defensible ground. The other, despite its impressive technology, is viewed as a castle built in the clouds, its foundations disconnected from financial gravity. So, what does the data actually tell us?

The Inarguable Moat

The bull case for Nvidia is almost deceptively simple. The company doesn't just sell chips; it sells the entire ecosystem for AI development. Its GPUs are the industry standard, but the true lock-in comes from its CUDA programming model. This is the digital soil in which nearly every major AI application has been grown. Competitors can design faster silicon—and many are trying (with help from firms like Broadcom and Marvell)—but they can’t easily replicate the decade-plus of software development, libraries, and developer loyalty built around CUDA.

Analysts like Beth Kindig of the I/O Fund label this an "impenetrable moat," and the term isn't hyperbole. It's an economic reality. To switch from Nvidia is not just a hardware swap; it's a fundamental re-engineering of a company's entire AI workflow.

From a valuation perspective, Nvidia certainly isn’t cheap. It trades at 54 times earnings. However, when juxtaposed with Wall Street’s expectation of 36% annual earnings growth over the next three years, the price begins to look, if not cheap, then at least justifiable. It's the premium you pay for a market leader with a well-defined, defensible position. The risk with Nvidia stock isn’t about competition in the near term; it’s about its own history of volatility. The stock has been cut in half seven times since its IPO. That's the price of admission.

A Valuation Divorced from Reality

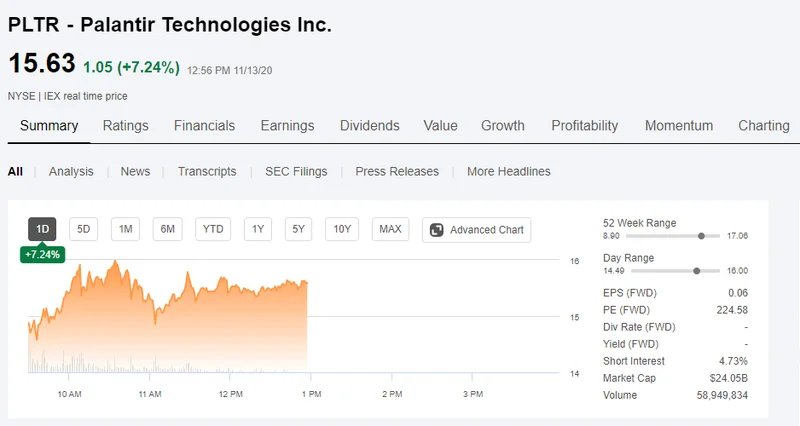

Then we have Palantir Technologies. The company’s software is, by all credible accounts, exceptional. Forrester Research placed its AI/ML platform ahead of offerings from Amazon, Microsoft, and Google. Its core innovation, the "ontology," creates a dynamic framework that maps digital data to real-world operations, allowing for sophisticated decision-making. CTO Shyam Sankar claims this gives the company a "massive lead," and eight straight quarters of accelerating sales growth suggest customers agree.

And this is the part of the analysis that I find genuinely puzzling. We have a company with best-in-class technology, accelerating growth, and a clear product-market fit. So why the sell rating?

The answer is one number: 137.

Palantir stock currently trades at 137 times sales. Not earnings—sales. To put that in perspective, the next most expensive stock in the S&P 500 is AppLovin, at a distant 43 times sales. This means the Palantir stock price could fall by two-thirds and it would still be the most expensive stock in the index on that metric. The valuation is a complete and total outlier.

I’ve heard the anecdotal argument that "valuation doesn't matter" for a company like Palantir, but that is a dangerously naive position. History provides a brutal counterpoint. A recent review of software valuations since the year 2000 found only seven other instances of a company trading above 100 times sales. The average decline from that peak valuation was 74%. That’s not a projection; it's a historical scar. The market eventually, and always, demands that financials catch up to the narrative. The question for Palantir isn't whether its technology is good. The question is whether it can generate a level of growth so stratospheric, so unprecedented, that it can possibly justify a valuation that has historically been a prelude to a catastrophic collapse.

The Math Is Inescapable

Ultimately, the divergence in Wall Street's view of Nvidia and Palantir isn't about technology; it's about financial discipline. Nvidia's narrative is backed by a fortress of a software moat and an earnings valuation that, while high, is tethered to a concrete growth forecast. Palantir's narrative, however compelling, is attached to a stock price that has floated into the stratosphere. The company’s success is real, but its valuation has become an exercise in speculative fiction. Investing is a game of probabilities, and the historical data overwhelmingly suggests that valuations like Palantir’s don’t end well. One stock is priced for success; the other is priced for a miracle.