Generated Title: Coinbase Stock Is a Rollercoaster Ride. But What's Driving the Insanity?

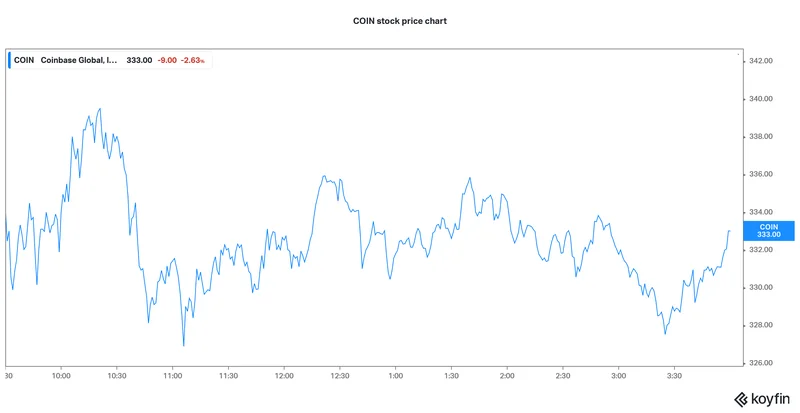

Watching the Coinbase (COIN) stock chart is an exercise in vertigo. One day it’s surging 5.9% on a broad crypto rally; a week earlier it was dropping 2.8% on a market-wide liquidation. The stock has made 59 moves greater than 5% in the last year alone. For context, that’s more than one significant swing a week. It’s a pattern of behavior that sends traditional, fundamentals-based investors running for the stability of a Treasury bill.

The surface-level explanations are always readily available. A major player like BlackRock deposits a few hundred million into Coinbase Prime. Bitcoin reclaims a key price level. An SEC Commissioner makes a vaguely positive comment about a “constructive era” for digital assets. The market reacts, the price jumps, and the financial news cycle has its story for the day. But this isn’t analysis; it’s just event-logging. It doesn’t explain the sheer violence of the moves or the underlying force that makes COIN so susceptible to this chaos.

The truth is, trying to value Coinbase on its quarterly earnings or user growth is like trying to measure the tide with a teacup. You’re using the wrong instrument entirely. The "insanity" of its price action isn't random noise. It's a signal that the market is using this stock for something else entirely.

The Asymmetry of a Hand Grenade

To understand Coinbase, you first have to forget about Coinbase. You have to understand the brutal and skewed nature of the stock market itself. For years, S&P Dow Jones Indices has been quietly publishing data that should be terrifying to anyone who thinks picking winning stocks is a 50/50 proposition. From 2001 through September 2025, only 19% of stocks in the S&P 500 actually managed to outperform the average stock’s return. In the first half of 2025, that figure was 44%. In 2024, it was a dismal 28%.

The odds are, quite literally, worse than a coin flip. Picking a market-beating stock is far from a coin flip 🪙

The reason for this is something analysts call positive skew. While a stock can only go down 100%, its upside is theoretically infinite. This creates a market where the average return is dragged far above the median return by a tiny handful of spectacular winners. Over the last two decades, the median S&P 500 constituent returned 59%, while the average return was a staggering 452%. Think about that. A few hyper-performers pulled the entire average up by nearly 400 percentage points.

This is the game. It’s not about finding decent companies; it’s about finding one of the outliers. Warren Buffett said it best in his 2023 letter: “Our satisfactory results have been the product of about a dozen truly good decisions… The weeds wither away in significance as the flowers bloom.” Research from professor Hendrik Bessembinder is even more stark: the top-performing 2.4% of firms account for all of the net global stock market wealth creation from 1990 to 2020.

And this is the part of the data that I find genuinely clarifies the Coinbase situation. Investors, perhaps subconsciously, understand this dynamic. They know the path to massive wealth isn't a diversified portfolio of "pretty good" companies. It's exposure to one of the "flowers." So, what is Coinbase if not the single most accessible, regulated, high-beta proxy for the entire crypto ecosystem's chance to become one of those flowers?

Owning COIN isn't a bet on its fee structure or its international expansion strategy. It's a highly leveraged bet that crypto, as an asset class, will be one of the 2.4% of ideas that reshapes the world. Coinbase is the lottery ticket for the whole damn lottery. Its price doesn't reflect its current financials; it reflects the market's constantly shifting odds on whether that lottery will pay out.

Pricing the Unknowable

This brings us to the regulatory circus in Washington. Every whisper from the SEC, every soundbite from Coinbase’s Chief Policy Officer, Faryar Shirzad, about "market structure legislation" is treated as a seismic event. Why? Because regulation is the single biggest variable in the probability calculation.

A clear, favorable regulatory framework in the U.S. doesn't just make Coinbase's operations easier; it validates the entire asset class. It dramatically increases the odds of the "long right tail" outcome, where crypto integrates into the global financial system. Conversely, a punitive crackdown doesn't just hurt Coinbase's bottom line; it threatens to kill the entire bet.

This is why the stock is so twitchy. A government shutdown might delay a bill. A positive speech from a regulator can send shares soaring nearly 4%, as we saw recently. Coinbase Stock (NASDAQ:COIN) Jumps as Senior Staff Talks Regulations These aren't minor news items; they are direct inputs into the asymmetric risk equation. The current state, a "pastiche of state and federal rules," keeps the outcome uncertain and the volatility engine running at full throttle.

So, is the market correctly pricing in this binary risk? Or is it just a chaotic mess of algorithmic reactions to keywords in headlines? I would argue it's the latter acting in service of the former. The day-to-day volatility is the frantic, inefficient price discovery process for an event that is, for now, fundamentally unknowable. It’s the hand grenade with the pin pulled. We know it will eventually stop being a grenade—either by exploding or being defused—but we have no idea when, so every tick of the clock causes a panic.

The numbers for long-term holders are telling. An investor who bought $1,000 at the IPO in April 2021 would have about $1,006 today. That’s a whole lot of volatility for a near-zero return. The stock is up substantially since the beginning of the year—to be more exact, 28.4%—but remains more than 20% below its 52-week high. This isn't a trajectory; it's a cardiogram.

A High-Beta Proxy for a Hypothesis

Ultimately, to analyze Coinbase stock on its own merits is a category error. The company's performance is secondary to its function. It has become the market's primary vehicle for speculating on the future of an entire technological and financial hypothesis. Its income statement is less important than the price of Bitcoin. Its user growth is less important than the legislative agenda in Congress.

The wild swings aren't a sign of market insanity. They are the logical, if jarring, result of the market attempting to price a low-probability, ultra-high-reward outcome in real time. Every piece of news, no matter how small, forces a recalibration of those odds. Buying COIN isn't an investment in a blockchain infrastructure company (though it is that). It's a pure, unadulterated bet on the outlier. And the price chart is simply the feverish, minute-by-minute ledger of that bet.