Let's get one thing straight. Every so often, a stock comes along that isn't really a stock. It's a personality test. It splits the world into two camps: the storytellers and the spreadsheet jockeys. And right now, Hims & Hers (HIMS) is the ultimate Rorschach test for Wall Street. You either see a revolutionary healthcare disruptor poised for world domination, or you see a wildly overpriced, wobbly company built on a foundation of pure hype.

There is no in-between. And the battle raging over the `hims stock price` is a perfect snapshot of the market's total disconnect from reality.

The Seductive Story Everyone Wants to Believe

You’ve heard the story. It’s a good one, I’ll give them that. Hims is the slick, millennial-friendly brand that’s cutting out the middleman. No more awkward doctor visits, no more dealing with insurance companies. Just a few clicks on a website and—poof—hair loss pills or ED meds show up at your door. They’re "vertically integrating" and "personalising care at scale." It all sounds so clean, so disruptive, so…inevitable.

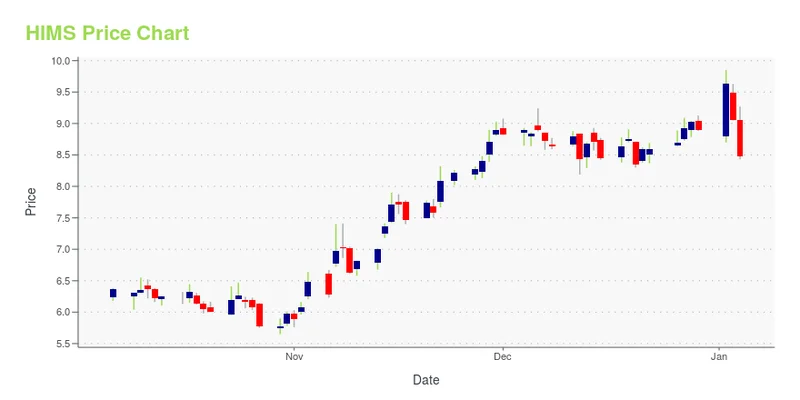

This is the narrative that sent the stock soaring 39% in a month. It’s the story that has analysts whispering about a "fair value" of $86 a share while it's trading in the 50s. People are high on the potential, drunk on the growth story. They see Hims not as what it is, but what it could be. It's the same Kool-Aid that fueled bubbles around everything from `tsla stock` to a dozen other profit-optional tech darlings.

It's like the new, impossibly cool smartphone that just launched. The marketing is brilliant, the design is sleek, and everyone on social media is raving about its revolutionary camera. You just have to have it. The story is perfect. But what the evangelists conveniently forget to mention is that the battery life is a complete joke. It looks amazing in your hand, but it’ll be dead by lunchtime. What good is a story if the machine can’t actually run?

The Ugly Math Nobody Wants to Look At

While the storytellers are busy dreaming, the math nerds are quietly pointing out that the emperor has no clothes. And man, the math here is ugly. This is where the whole fantasy starts to crumble.

Let's start with the basics. The stock trades at a price-to-earnings ratio of over 67x. The rest of the healthcare industry? Around 21x. Its forward P/E is even more absurd, sitting at nearly 95x. Zacks, a service that literally grades stocks for a living, gives Hims a "Value" grade of D. A "D"! In school, that means you're one step away from summer school. In the stock market, it means you're paying a premium for… what, exactly? A good story? That ain't a business model.

Then there's the C-suite shuffle. Just as the hype train was leaving the station, the company announced its COO was vacating his position to become an "advisor." They call it "ongoing strategic guidance," which is corporate-speak for… well, who the hell knows what it means, but it rarely means things are going perfectly. The market, for once, reacted rationally, sending the stock down 9% on the news — a reaction that helps answer Why Hims & Hers Stock Slipped Today. Investors like consistency, not a game of executive musical chairs. If the growth is so explosive and the future so bright, why are key players shifting around?

This is the stuff that gets ignored when you're caught up in the narrative. The P/B ratio is over 22, while a boring-but-stable competitor like Omnicell sits at 1.11. This stark contrast is at the heart of the debate over OMCL or HIMS: Which Is the Better Value Stock Right Now? The numbers are bad. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of a valuation. You're not buying a business at these levels; you're buying a lottery ticket based on a well-told bedtime story. And offcourse, sometimes lottery tickets hit. But most of the time, they just end up in the trash.

So, What's the Real Play Here?

Look, I get the appeal. The story is compelling. The idea of disrupting the crusty old healthcare system is a powerful one. But at some point, a business has to be a business. It has to be judged on its numbers, its stability, and its ability to turn a profit without being valued like it's already cured death. Right now, Hims is a battle between a beautiful fantasy and a brutal reality. The market is betting on the fantasy. I wouldn't. This whole thing feels like it’s one bad quarter away from a serious reality check. The story is great, but the math just doesn't add up.