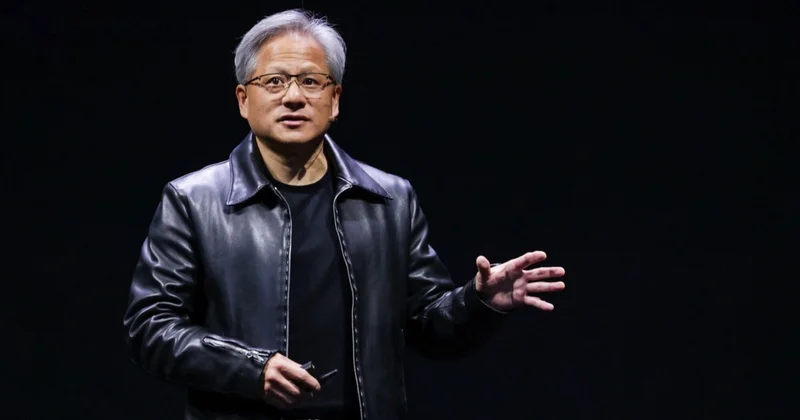

The story, as told by Arm CEO Rene Haas, is the kind of legend that echoes through the halls of Silicon Valley. It’s a clean, potent narrative of visionary leadership: one man, one meeting, one decision that changes everything. Speaking at the All-In Summit, Haas recounted a pivotal moment from his seven-year tenure at Nvidia. During a routine off-site meeting, Jensen Huang, the formidable CEO of Nvidia, stood before his team and effectively detonated their business roadmap.

"We're abolishing this product line," Haas recalled Huang declaring. "We're going to move 2,000 engineers off of project X onto project Y."

At the time, Nvidia employed roughly 6,000 people. This wasn't a minor course correction; it was a violent, company-altering pivot. Engineers were pulled from developing support chips for Intel processors—a stable, if uninspired, line of business—and thrown headfirst into the world of Arm-based designs and advanced graphics. The rest, as they say, is history. The move laid the groundwork for Nvidia’s eventual dominance in GPUs and, subsequently, the AI revolution. For Haas, the lesson was clear: leadership requires "vision, speed, fearlessness, taking risk, and an ability to pivot very, very fast." Arm CEO on lesson learnt while working under Nvidia founder Jensen Huang: He would change strategy at an off-site meeting meant to…

It's a compelling story. It’s also, from a purely analytical perspective, an oversimplification.

The Anatomy of a High-Stakes Bet

Let’s break down the numbers. The decision to reallocate 2,000 engineers represents a sudden redirection of about a third of the company's entire technical workforce—or, to be more exact, 33.3% of the stated 6,000-person headcount. This is a monumental gamble. In corporate strategy, we’re taught to model risk, diversify portfolios, and hedge our bets. Huang’s move, as described, is the equivalent of a portfolio manager liquidating a third of their holdings in blue-chip stocks to go all-in on a volatile, unproven asset class.

The narrative frames this as a singular moment of brilliant, almost impulsive, insight. But was it? A decision of this magnitude is rarely conceived in a vacuum. What preliminary research was conducted? What market analysis suggested that the Intel support chip business was a dead end and that Arm-based systems were the future? The story Haas tells focuses on the what, but my analysis is always drawn to the why and the how. The dramatic announcement at an off-site is the theatrical climax, but it almost certainly wasn't the beginning of the play.

This is the classic "Hail Mary" fallacy in business storytelling. We lionize the game-winning, last-second throw, forgetting the hundreds of hours of film study, the thousands of practice reps, and the meticulous game plan that put the team in a position to even attempt it. To credit Nvidia’s success solely to one fearless decision is to ignore the immense, data-driven groundwork that must have preceded it. Was Huang’s team already modeling the decline of their current market? Were there skunkworks projects that had already demonstrated the potential of the new direction? The anecdote leaves these critical questions unanswered. Without that context, the lesson isn't "make bold pivots," it's "get lucky on a wild guess." I suspect the former is far closer to the truth.

And this is the part of the report that I find genuinely puzzling: the persistence of this "great man" theory of corporate strategy. It suggests that success is a function of individual daring rather than institutional process and rigorous analysis. While Huang's courage is undeniable, the infrastructure required to execute such a pivot—to retrain and redeploy 2,000 engineers without the company collapsing—is the real, unsexy miracle here.

The Echo in Arm's Boardroom

The most interesting aspect of this anecdote isn't what it says about Nvidia’s past, but what it might signal about Arm's future. Haas didn’t just learn a lesson in leadership; he internalized a strategic doctrine from one of the most successful tech executives in modern history. Now, he sits at the helm of Arm, a $150 billion company whose entire business model is built on licensing its architecture to other firms—including its largest and most important customers, like Nvidia.

This creates a fascinating dynamic. Arm is the quiet enabler, the foundational layer upon which giants are built. Nvidia's latest AI chips, for instance, combine its own powerful GPUs with Arm-based CPUs. The relationship is symbiotic and immensely profitable for both parties (a relationship with significant revenue implications for Arm). Yet, when asked at the summit if Arm might one day manufacture its own chips and compete directly with its clients, Haas was strategically vague. He didn't say no.

This is where the echo of Huang's lesson becomes deafening. Is Haas, armed with the memory of that off-site meeting, contemplating his own company-altering pivot? The idea of Arm, the neutral "Switzerland of the chip world," becoming a direct competitor to Nvidia, Qualcomm, and Apple is a scenario that would send shockwaves through the entire semiconductor industry. The impact on Nvidia stock, and the stocks of every other Arm licensee, would be immediate and chaotic.

Of course, the strategic calculus is vastly different. Nvidia was pivoting away from a symbiotic relationship with Intel to forge its own path. Arm would be pivoting against its entire customer ecosystem. It would be a declaration of war on the very companies that made it a powerhouse. Such a move would require a level of fearlessness that would make Huang's pivot look timid by comparison. Details on whether this is a serious consideration remain nonexistent, but the fact that the CEO is willing to entertain the question publicly is, in itself, a significant data point. It suggests a willingness to question the foundational assumptions of his own business—the very same trait he so admired in his former boss.

The Seductive Error of the Single Pivot

My core takeaway is this: The story of Jensen Huang’s grand pivot is a powerful piece of corporate mythology, but it’s a dangerous blueprint if misinterpreted. The real lesson isn't about the single, dramatic decision. It's about the painstaking, unglamorous work of building an organization so robust, so data-informed, and so agile that it can execute a high-stakes pivot when a strategic window opens. Nvidia's dominance wasn't born in that one meeting; it was merely christened there. The foundation was laid long before. For Rene Haas and Arm, the question is whether they are simply admiring the legend or are quietly laying a new foundation of their own.