Let's get one thing straight. When a crypto token explodes 600% in a day, the last thing you should be looking for is a "fundamental reason." You're not witnessing the birth of a technological revolution. You're watching a perfectly executed casino heist, and everyone's invited to place a bet before the house inevitably takes it all back.

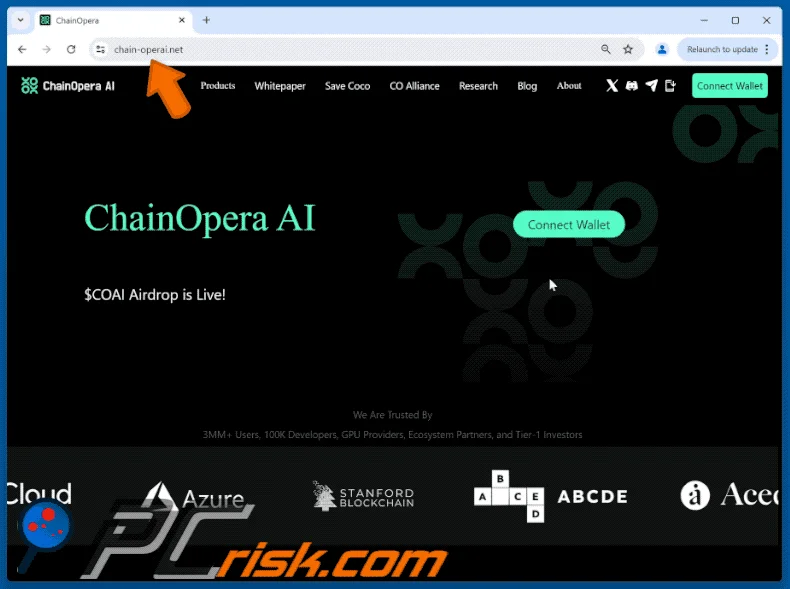

The story of ChainOpera AI ($COAI) is being spun as a masterclass in strategy. A tale of "precise timing," "solid technology," and a "deep understanding of the market." Give me a break. I’ve read enough of these post-mortem PR pieces, like The Secret Behind ChainOpera AI’s Explosive Success: Strategic Cycle Timing and a Fully Diluted Valuation Beyond $4 Billion, to know the script. They throw a bunch of jargon at a wall—AI Agents, DePIN, Web3 infrastructure—and hope you're too impressed, or too bored, to ask the only question that matters: Is anyone actually using this stuff?

The answer, almost always, is no. What we have here isn't a story about technology. It's a story about timing, leverage, and manufacturing hype so potent it makes you forget you're gambling on thin air.

The "Perfect Storm" Playbook

The narrative they're selling is that ChainOpera AI brilliantly navigated the market. They saw the AI track was heating up, so they jumped in. They noticed the BNB Chain was buzzing, so they launched there. They saw perpetuals trading was going parabolic, so they made that their core listing strategy.

This isn't genius. It’s just paying attention. It’s like opening an umbrella store during a monsoon and then writing a press release about your visionary insights into meteorology. Offcourse you’re going to sell umbrellas. The market was already primed and desperate for the next shiny AI token to gamble on. Early projects had already done the hard work of "educating the market," which is corporate-speak for "building the hype bubble." ChainOpera just showed up with a bigger pin.

They claim this saved them marketing costs, which they funneled into "product development." Right. Let's talk about that product. The fact sheet proudly states it’s a "complete AI ecosystem that has been implemented and is under operation." I’ve heard that one before. It's the crypto equivalent of a movie trailer that shows all the best scenes, leaving you with a two-hour-long snoozefest. But when the music stops, who’s actually using this "full-stack AI infrastructure" for anything other than speculating on its token price? Are we supposed to believe the 300,000 people using BNB to access their services are all suddenly AI developers? Or are they just trying to get in on the next 100x pump?

This is the oldest trick in the book. Dangle a functional-looking product, wrap it in the hottest narrative you can find, and let human greed do the rest.

Follow the Leverage, Not the Tech

If you want to understand the real story behind the $COAI pump, don't look at their website. Look at the derivatives data. The project launched right as daily trading volume for perpetual futures on the BNB chain shot past $100 billion. One hundred. Billion. Dollars. That’s not adoption; that’s a global casino running at full tilt.

ChainOpera AI’s core strategy was to become the new favorite slot machine. And boy, did it work. Their single-day perps trading volume topped $6 billion, briefly surpassing giants like SOL and BNB. This wasn't driven by people who believe in a decentralized AI future. It was driven by degens with 25x leverage, trying to catch a falling knife or ride a rocket to the moon. The high funding rates and $17 million in short liquidations tell you everything you need to know. This was a bloodbath, and a profitable one for the house.

The project even boasts about solving the "industry pain point" where product users and token holders are different groups. Their solution? A "funnel" that converts product users into token holders. This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of an idea. You're not creating a loyal community; you're turning anyone who touches your product into a speculator with a vested financial interest in its hype. It creates a feedback loop where the only thing that matters is the number going up, not whether the tech is any good.

And honestly, every single project claims to be solving this. It’s like how every startup is "disrupting" an industry. It’s a meaningless platitude that sounds good to venture capitalists and people who don’t know any better.

Hype is a Hell of a Drug

To top it all off, they didn't even launch alone. On the same day, a stablecoin project called $XPL also went live. The result was a "resonance effect," a cutesy term for a bog-standard marketing gimmick. Throw two parties on the same night and call it a block party. Investors, gripped by a severe case of FOMO, started "bundle buying," because why bet on one horse when you can bet on two?

Then the social media machine kicked in. Influencers and "Key Opinion Leaders" started tweeting, comparing it to other legendary pumps, creating an inescapable vortex of hype. You see a 600% green candle on your screen, you see a dozen Twitter accounts with anime profile pictures telling you it’s going to $5, and you start to believe. You forget to ask why. You forget to wonder if there’s anything real behind the ticker.

Some people are even pointing to a shady past, alleging the team was behind a previous rug-pull. But in a market like this, who cares? As long as the price is going up, all sins are forgiven. People will knowingly buy into a scam if they think they can sell it to a greater fool before it all comes crashing down. And that’s the part that really gets me. This entire episode is being framed as a win, a blueprint for success in Web3. But it’s a success built on speculation, leverage, and carefully manufactured FOMO. It’s a model that ensures for every person who gets rich, a hundred others are left holding the bag when the music stops. And it always, always stops...

So, We're Calling This 'Success' Now?

Let's be brutally honest. ChainOpera AI didn't succeed because it built a revolutionary product. It succeeded because it built a better mousetrap for gamblers. It perfectly packaged the AI narrative, launched into a liquidity-fueled frenzy on the BNB chain, and used leveraged trading as the engine for a speculative supernova. To call this a "benchmark project" for "AI + Blockchain Integration" is an insult to anyone actually trying to build something real. This isn't the new era of anything. It's just the same old crypto casino with a fresh coat of AI-themed paint. And the house always wins.