It’s a scene you might expect from a movie, maybe even an episode of Ted Lasso. An American billionaire, a titan of industry, finds himself not in a sleek Silicon Valley boardroom, but in a place like Bournemouth, a quintessential English seaside town known more for fish and chips than for global finance. He’s buying the local soccer team. And he’s not alone. It's a trend that begs the question: Why are so many rich Americans investing in British soccer teams?

This is happening all across the UK. From the global powerhouses of Manchester United and Liverpool to third-tier clubs in Yorkshire, American money and influence are pouring in. More than half the teams in England’s top four leagues now have some form of American ownership. The easy answer, the one you’ll get from a standard financial analysis, is that it’s a market inefficiency. It’s a simple arbitrage play. As Bournemouth's president of business, Jim Frevola, points out, you can buy a Premier League team for a fraction of the cost of an NFL or NBA franchise. Case closed, right?

Wrong. I have to admit, when I first heard about this trend, I was skeptical. Another case of American capital swallowing up foreign culture? But the more I looked, the more I realized I was completely wrong. This isn't just about finding undervalued assets. This is something far more profound, a search for something we’ve lost and a glimpse into a future where data and soul don’t have to be at odds. This is one of the most fascinating human-centric experiments happening in the world today.

The Search for Authentic Code

Let's be honest. For all our technological progress, for all our interconnectedness, there's a growing sense of detachment in modern life. We communicate through screens, build communities in algorithms, and measure success in metrics that often feel hollow. So what does an investor like Kevin Nagle, who owns a team in Sacramento, do? He buys Huddersfield, a team in Yorkshire, sight unseen. He didn't run the numbers on a spreadsheet and close the deal. He bought into an idea.

Why? Because these clubs are more than businesses; they are living, breathing archives of human connection. Nagle himself says it best: "It's just amazing when we see a lot of our fans, because their great, great, great-grandparents were watching the team play." You can't replicate that. You can't code that. It's a century of shared joy and heartbreak, passed down through generations, concentrated in 90 minutes every Saturday.

This is the real asset being acquired. It’s like buying a historic French vineyard. The land and the equipment have a price, but the real value is in the terroir—the unique combination of soil, climate, and generations of human knowledge that gives the wine its soul. These American owners aren't just buying sports franchises; they're acquiring cultural terroir. They're buying a piece of something real, something with a history that stretches back long before the digital age. In a world of fleeting digital trends, is there a better long-term investment than a community's unwavering heart? What does it say about our own culture that our wealthiest are looking overseas not just for financial returns, but for a sense of durable, authentic belonging?

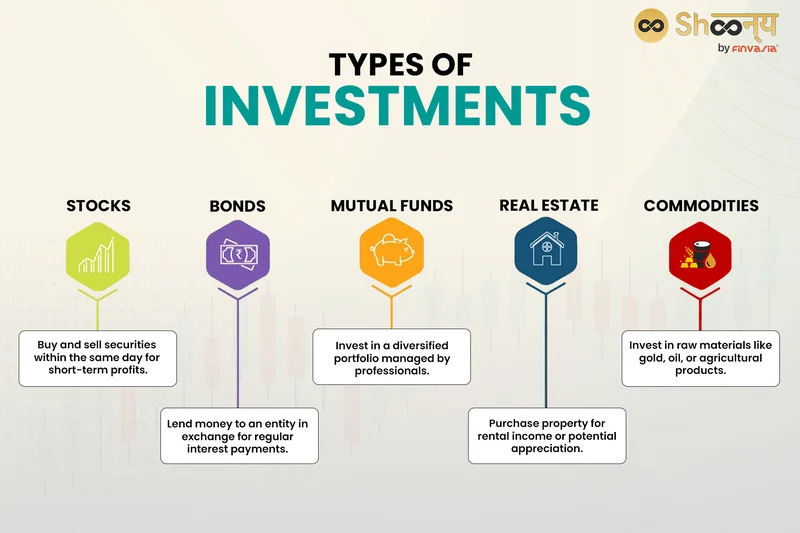

These are not the kinds of opportunities you'll find listed under "alternative investments" at your typical brokerage like Fidelity Investments or Vanguard. This is an investment in human passion, an asset class that defies traditional valuation. They're buying a club, not a franchise—and that's a crucial distinction. In simpler terms, a franchise can be moved, its identity changed on a whim, but a club is welded to its town, its people, its history.

A Beautiful Collision

Of course, the moment American money shows up, so does the American way of doing things. You see it with celebrity investors like Ryan Reynolds, Tom Brady, and Will Ferrell, who bring a Hollywood flair for storytelling and brand-building. They aren't just owners; they're evangelists, using documentaries and their own star power to amplify the club's story on a global stage. This is where things get truly interesting.

What we're witnessing is a grand fusion. It's the collision of two completely different philosophies. On one side, you have the data-driven, commercially savvy, relentlessly optimistic American approach to sports. On the other, you have a century of British tradition, gut feelings, and a deeply ingrained, almost sacred, relationship between a team and its town. The fear, naturally, is that the American influence will sanitize the experience, turning these historic clubs into sterile entertainment products, complete with "all-star games" and other gimmicks.

But that’s not what’s happening. Instead, we're seeing a powerful synthesis. The American investment is professionalizing operations, upgrading stadiums, and, importantly, pouring resources into women's soccer—an area they've long championed. This is where the magic happens, where American analytics and performance metrics meet the raw, unquantifiable passion of a fan whose great-grandfather stood on the very same terrace, creating a hybrid model that could redefine not just sports management but community engagement itself.

You can feel the energy shift just by listening to the fans. In a pub near Bournemouth's stadium, you don’t hear resentment; you hear hope. "The stadium looks a lot smarter now," one says. "It's been incredible," says another. "It feels like the sky's the limit." This is the on-the-ground truth. As long as the new owners respect the core identity—the "terroir"—the fans are open to innovation. The only real responsibility here, the core ethical consideration, is to be a steward, not a conqueror. To add a new chapter, not erase the old ones.

The New Global Campfire

So, what are we really looking at here? It’s not a hostile takeover. It’s a cultural bridge. This is American capital, technology, and marketing savvy flowing into institutions that possess something increasingly rare: a century of authentic, uninterrupted human connection. It's a symbiotic relationship where one side provides the resources to thrive in the 21st century, and the other provides a powerful reminder of what it means to truly belong to something. This isn't just one of the best investments for a portfolio; it’s an investment in a model for a more connected, passionate, and hopeful global future. And that’s a game we all win.