The Last Good Data Point Before We Fly Blind

The market’s reaction to the September CPI data release was, to put it mildly, euphoric. The numbers came in a hair better than consensus, and in the world of high-frequency trading and algorithm-driven narratives, a slight beat is all it takes to uncork the champagne. The consensus narrative solidified within minutes: inflation is on the run, the Federal Reserve has its green light, and a quarter-point rate cut (25 basis points) is now a near-certainty for October.

On the surface, the optimism appears justified. The CPI data report showed that key drivers of inflation—housing, shelter, and food—all decelerated. John Hilsenrath of StoneX captured the mood perfectly, calling the news "very bullish" and suggesting the market would immediately begin pricing in a second rate cut for December. This is the clean, simple story the market craved, with some analysts concluding the CPI data solidifies Oct. rate cut, 'very bullish' for US stocks. After a long and painful hiking cycle, here was the data point that seemingly validated the Fed’s strategy and offered a clear path forward. The Fed, as Hilsenrath noted, would feel "comforted" by this.

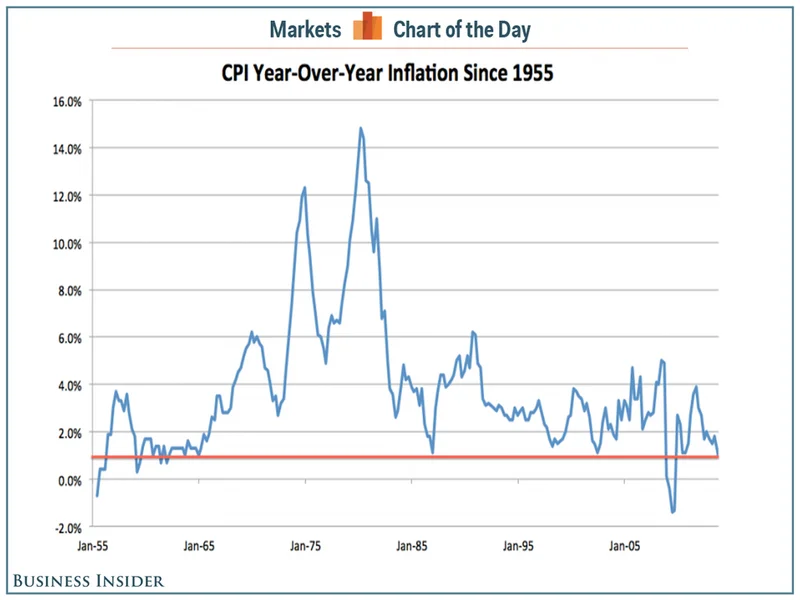

But comfort derived from a single, backward-looking data point is often a precursor to a significant miscalculation. While the headline numbers provided a dose of relief, the underlying components tell a less triumphant story. Services inflation is still advancing at a 3.6% year-over-year clip. Food remains elevated at 3% annually. Even with the deceleration, the overall inflation rate is still at 3%—or, depending on the exact series you track, slightly higher. That is a full 100 basis points above the Fed's stated 2% target. This isn't victory; it's a temporary lull in a battle that is far from over. The market, however, has already declared the war won and is planning the victory parade.

The Data Blackout That No One Is Pricing In

The real story of the September US CPI data isn't in the numbers themselves, but in a chilling methodological warning that was delivered almost as an aside. In the same discussion, RSM's Chief Economist, Joe Brusuelas, dropped a bombshell that seems to have been completely ignored by the market's bullish stampede: this is likely the last high-quality, reliable inflation report we will receive until early next spring.

This is the part of the analysis that I find genuinely alarming. Due to the recent government shutdown, the Bureau of Labor Statistics (BLS) will face significant challenges in its data collection processes. As Brusuelas explained, the agency will be forced to "impute" data, which is a sterile, clinical term for what is, essentially, a highly educated guess. They will be substituting missing values with statistical estimates based on old data. For the next several months, the core economic indicator guiding Federal Reserve policy will be partially fabricated.

Let's put this into a more visceral context. This is like a pilot receiving a single, clear weather report for their current location, while knowing that for the next six hours of flight through a treacherous mountain range, all their navigational instruments will be offline, forcing them to fly by memory and guesswork. The initial clear report is nice, but it’s functionally useless for navigating the danger ahead. Yet, the market has reacted as if that first report guarantees a smooth landing. How can the Fed be expected to make precise, multi-billion-dollar policy decisions when its primary input is compromised? What happens if the imputed BLS cpi data shows a continued cooling trend, while the real, uncollected data indicates a sharp reacceleration in prices?

This introduces a level of uncertainty that renders any confident forecast about Fed policy almost meaningless. I've analyzed datasets for years, and the one thing that terrifies any analyst is GIGO—Garbage In, Garbage Out. When the integrity of your primary input is compromised, any model you build on it is a fantasy. The market is currently building a very expensive fantasy on a foundation of questionable data. It raises a critical question: is the market's optimism a reflection of genuine economic confidence, or is it a willful act of ignoring a glaring, systemic risk right in front of its face?

The Signal Is Dead, But the Noise Is Louder Than Ever

My analysis suggests the market's reaction is profoundly shortsighted. The celebration of the September CPI data today is a classic case of focusing on a single tree while ignoring the fact that the rest of the forest is about to go dark. The real takeaway from this week wasn't that inflation cooled by a tenth of a percent; it's that the reliability of our most crucial economic metric has been severely degraded for the foreseeable future.

The Federal Reserve is now tasked with navigating the end of a historic inflation fight while effectively blindfolded. Every decision from here until the spring will be based on lagging, incomplete, and partially estimated data. The probability of a policy error—either cutting rates too soon and allowing inflation to become re-entrenched, or holding them too high for too long based on flawed numbers and tipping the economy into a recession—has just increased exponentially.

Yet, asset prices have rallied. The narrative is set. The rate cuts are coming. The market is hearing what it wants to hear, even if the signal has been replaced by static. This isn't a bullish setup. It's the setup for a major policy accident.