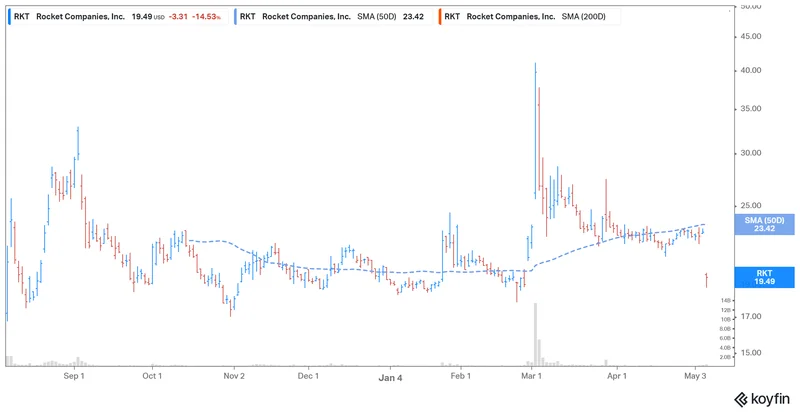

So, is Rocket Companies a screaming buy or a sinking ship? Good question. The answer, apparently, depends on which browser tab you have open and how much coffee you’ve had. One minute, the stock is getting hammered because Jerome Powell sneezed in a way the market didn’t like. The next, it’s the second coming of the housing boom, powered by San Francisco tech bros and their AI-fueled paychecks.

Welcome to the modern stock market, folks. It's not about fundamentals anymore. It's about navigating a firehose of schizophrenic headlines that contradict each other by the hour. I can just picture some poor soul, a retail investor trying to do their homework, staring at their screen as the ticker flips from blood red to vibrant green. Their coffee goes cold, their eyes glaze over, and they start to wonder if they accidentally ingested mushrooms for breakfast.

This is what they call "information." This is what’s supposed to empower us. Give me a break.

The Two-Faced Prophet of Wall Street

Let's try to untangle this mess. On one hand, you have the doomsayers. The Federal Reserve isn’t promising a waterfall of rate cuts, so borrowing costs might stay high. For a mortgage lender like Rocket, that’s like hearing the forecast calls for a permanent drought. The logic is simple: higher rates mean fewer people buying houses or refinancing. The stock takes a 7% nosedive. Makes sense. It’s clean, it’s logical.

But then, click a different link, and you’re in a parallel universe where analysts ask Will Rocket Companies’ Stock Soar?. In this reality, Rocket is at the heart of a "significant upswing" in the housing market. They’re crushing it with luxury homes, their Redfin partnership is "accelerating momentum," and they’re projecting a monster fourth quarter with over $2 billion in revenue. The stock is up 4.3%. Everyone’s high-fiving.

So, which is it? Is the company sensitive to interest rates, or is it immune because of the AI boom? Can both be true? This isn’t just market volatility. No, 'volatility' is too clean a word—this is a casino where the house keeps changing the rules of blackjack halfway through the hand. They tell you to look at the numbers, but the numbers themselves seem to be having an argument. They beat earnings-per-share estimates by a few pennies but missed revenue targets. That’s like a quarterback throwing a touchdown pass for the other team. How do you even score that?

And Who the Hell is Reckitt Benckiser?

Just when you think you might be getting a handle on it, the internet throws you a curveball that’s not just from left field but from a different sport entirely. While trying to figure out if an American mortgage company is a good investment, my feed starts serving up things like Patricia Verduin Buys 135 Shares of Reckitt Benckiser Group (LON:RKT) Stock, a report about a British conglomerate that makes Lysol, Durex condoms, and Mucinex.

You can't make this stuff up. The ticker is RKT, but on the London Stock Exchange.

Trying to research Rocket Companies today is like ordering a pizza and getting a box full of spare alternator belts and a single, lukewarm breadstick. Sure, they're both things you can buy, but one of them ain't gonna solve your problem. It's a perfect, beautiful illustration of the algorithmic slop we now live in. How much of the "data" driving billions of dollars in automated trades is just this kind of garbage-in, garbage-out noise? Are we really sure the trading bots aren't buying a mortgage company because they saw a positive report on cold medicine sales? Then again, maybe I'm the crazy one for expecting any of this to make sense.

This is the part that really gets me. It’s not just the conflicting narratives; it’s the outright pollution of the information ecosystem. It’s like trying to have a serious conversation in a room where three different Slayer albums are playing at full volume. Offcourse, you can't hear the signal for the noise.

So, What's the Real Play Here?

If you strip away the nonsense about British consumer goods and the dueling headlines, what are you left with? A company that is navigating a deeply uncertain housing market. A company that is making big, expensive bets on acquisitions like Redfin and Mr. Cooper to build some kind of all-in-one "homeownership platform."

They’re trying to sell a narrative of tech-driven disruption in a sector that’s fundamentally tied to the most boring metric on earth: interest rates. They want you to believe their AI and strategic pivots can defy financial gravity. Their optimistic Q4 revenue projection is a testament to that confidence. They’re telling the world that even if the tide is going out, their boat is a rocket ship.

And maybe it is. Or maybe it’s just a regular boat with "Rocket Ship" painted on the side in really big, hopeful letters. They're betting the farm on this vision, and the conviction is admirable, but the market's reaction shows that nobody really knows if the bet will pay off. They want to be a tech company, but they're still selling mortgages. It’s a tough story to sell when your core product’s affordability is getting torched by the Fed.

A Casino With Extra Steps

Let's be brutally honest. Trying to form a coherent, long-term investment thesis on Rocket Companies based on this chaotic swirl of information is a fool's errand. It's not investing; it's gambling on which narrative wins the day. One report tells you to be terrified of interest rates, another tells you to be ecstatic about luxury home sales. A third tells you about the stock performance of Dettol. It’s all just noise, algorithmically generated and designed to make you do something—buy, sell, panic, rejoice. The one thing it’s not designed to do is make you smarter. The real story here isn't about RKT; it's about the broken machine we rely on to understand the market. Good luck. You're gonna need it.